“Today, people accept title and title transfer to real property. With the present high value of property, delineation must be exacting and interpretation made with extreme caution. The property surveyor must have an adequate understanding of the background of land titles to approach property problems intelligently.”

Brown, Robilland, Wilson

Evidence and Procedures for Boundary Location, Third Edition.

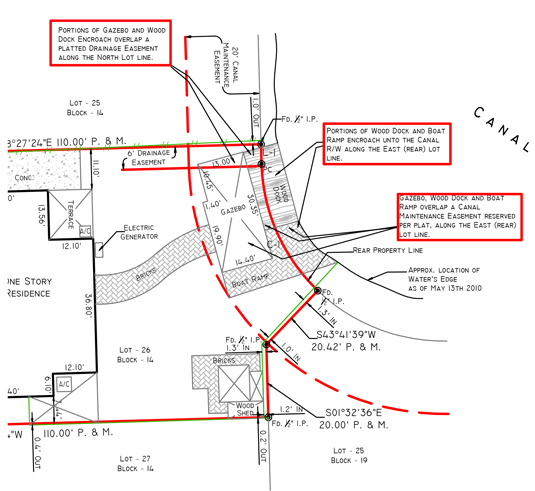

A Mortgage Survey is the same as a Boundary Survey. It must be performed with the same rigor as a Boundary. It must comply with Board regulations and must be prepared under the supervision and direction of a registered Land Surveyor and Mapper. The only different is that it is used for Title Underwriters to make exceptions to Title Insurance Policies and it is always a requirement by lenders before granting a mortgage. Usually it is certified to all the parties involved in a real estate transaction and lists any visible encroachments over easements or adjoining parcels, as well as points of interests that the title professionals might deem necessary.

WHY CHOOSE BELLO & BELLO FOR YOUR MORTGAGE SURVEY?

- Hiring Bello & Bello for the original mortgage/title survey is a smart decision. We will apply to that survey the same standard of quality that guides all our survey/mapping services.

- We will tailor that survey to meet the lender’s and closing agent’s requirements and will produce a clear sketch that mirrors actual field conditions.

- We will list all the encroachments, apparent uses, gores or overlaps, if found.

- We will plot all the encumbrances and easements of record that affect the parcel.

- We will carefully evaluate any discrepancies found between records and field.

- We will be able to tackle any title issue, encroachments or problem that might directly affect your initial investment.

- You will save money in the additional necessary services, not having to hire another survey company, but simply calling us for an update once you decide to remodel, rezone, develop or simply refinance.